If you believe there are errors on your credit report, it’s important to take action to dispute them. Your credit report can affect your ability to get approved for loans or credit cards, as well as the interest rates you’ll be offered. In this post, we’ll walk you through the steps of disputing errors on your credit report.

- Review your credit report The first step in disputing errors on your credit report is to review it. You can request a free copy of your credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year. Make sure to review all three reports, as the information on them may differ.

- Identify the errors Once you’ve reviewed your credit report, look for any errors or inconsistencies. These can include inaccurate personal information, such as your name or address, as well as incorrect account information, such as missed payments or collections.

- Gather supporting documentation If you find errors on your credit report, gather any supporting documentation you have that can help prove your case. This can include bank statements, letters from creditors, and receipts.

- File a dispute with the credit reporting agency Once you’ve identified the errors and gathered supporting documentation, you can file a dispute with the credit reporting agency. You can do this online, by mail, or by phone. Be sure to include any supporting documentation you have and a clear explanation of the errors you’re disputing.

- Follow up After you’ve filed your dispute, follow up with the credit reporting agency to ensure they’ve received it and are working on it. You should also follow up if you haven’t heard back from them within a reasonable amount of time.

- Monitor your credit report After the dispute is resolved, it’s important to monitor your credit report to ensure the errors have been corrected. You can request a free credit report from each of the three major credit reporting agencies once a year.

In conclusion, disputing errors on your credit report can be a simple process if you take the time to review your credit report, gather supporting documentation, file a dispute with the credit reporting agency, and follow up. Remember to keep monitoring your credit report for any errors and be vigilant about your credit score. It’s important to review your credit report regularly to ensure that the errors have been corrected and to track your credit score. Keep in mind that credit reporting agencies have 30 days to investigate and respond to disputes.

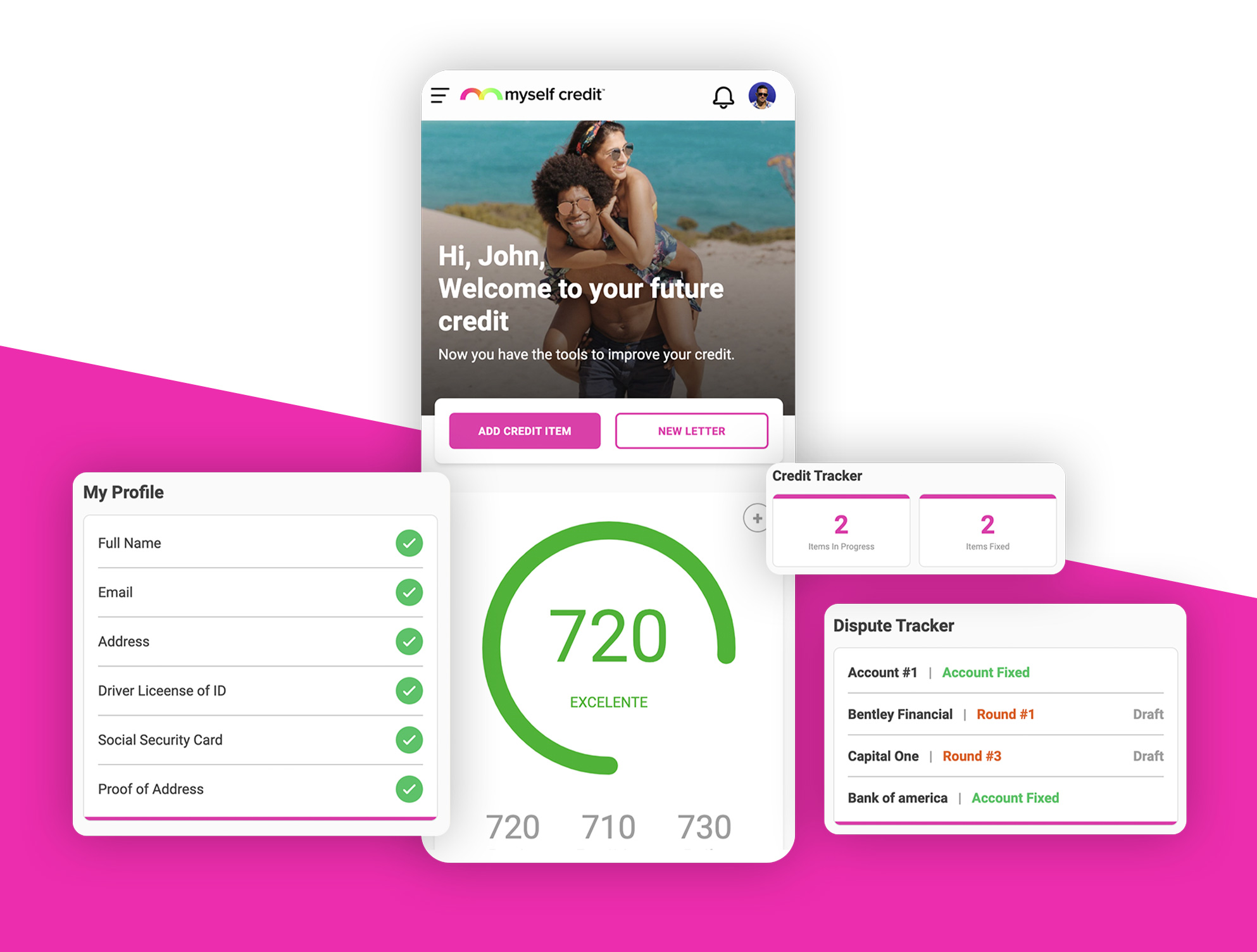

Myself Credit is the Easiest, Fastest, and most Innovative dispute creator software. More than 15 years of experience were the inspiration to create this solution to simplify the credit repair process. With Myself Credit, fixing your Credit and increasing your score is very simple. Your life will change by following several steps and applying our credit tips.